Tier 3 (Bands 7-8)

Effective March 25, 2021

Version 1.3

Introduction

Congratulations on your upcoming domestic relocation with Thermo Fisher! Thank you for your dedication to serve our customers and each other, globally, as we continue in our mission to make the world healthier, cleaner, and safer. We are pleased to offer a benefit package to facilitate your relocation into your new work location so you can make the most of this unique opportunity.

Thermo Fisher’s Global Mobility team is responsible for delivering a scalable mobility process model and enabling rapid deployment of critical skillsets to achieve business objectives and positive and seamless colleague experience. A dedicated team member will be your internal point of contact throughout your journey.

Throughout your relocation there are numerous personal, legal, and tax issues to be considered. Making well informed decisions requires an understanding of Thermo Fisher’s policy and your role in the process. Please take the time to read this policy carefully and ensure you understand its contents.

Thermo Fisher’s relocation partner will be responsible for the management of relocation and support services. They contract with several third-party preferred partners, globally, to provide a variety of services such as local neighborhood orientations. As it is a condition of your relocation that you use this provider, Thermo Fisher will not pay for costs billed by any other company. A Global Mobility team member from Thermo Fisher, who will be responsible for managing your relocation, will authorize a relocation partner to coordinate the services outlined within this policy.

Relocation Program Eligibility

The Thermo Fisher Global Domestic Relocation program is designed to facilitate a move that brings you substantially closer to your new work location. It is expected that your new residence will be within a reasonable commuting distance to your new work location.

To be eligible for this relocation program, the following criteria must be met:

• You must be a current or newly hired, full-time, regular Thermo Fisher employee

• The relocation must be initiated and approved by Thermo Fisher

• The distance between the former residence and the new work location must be at least fifty (50) miles/eighty (80) kilometers greater than the distance between the former residence and the former work location

• You must sign and return the Relocation Repayment Agreement and Policy Acknowledgement before any relocation benefits can be administered

• All reimbursable relocation expenses must be incurred within one (1) year from the effective date of your relocation or hire

Relocations for the convenience and/or at the request of the employee are not eligible for any relocation benefits contained in this policy.

If an eligible dependent is asked to relocate by Thermo Fisher, only one (1) individual would receive relocation benefits.

All participants, both current and newly hired, are referred to as “employee” throughout this document.

There is no cash value in lieu of benefits nor trading of benefits for one another. As the company is making a significant investment for this relocation, it is Thermo Fisher’s expectation that you are reasonable, mindful, and cost conscious in utilizing your relocation benefits.

All relocations are expected to be completed within one (1) year of the start date in the new location.

Scope of Policy

The policies and procedures outlined here apply to all Thermo Fisher Canada locations/entities and pertain to employees who will relocate within Canada, and their qualified dependents, who are in Bands 7-8. You may need to consult with the Thermo Fisher Global Mobility team and/or our relocation partner in instances requiring further interpretation of this policy, either before or after your move. Thermo Fisher Global Mobility retains ultimate discretionary authority to amend, modify, suspend, terminate, or interpret the policy or any of its provisions at any time. This policy does not constitute a contract or guarantee of employment.

To remain eligible for all the benefits of the relocation program, you must work with our relocation partner’s preferred partner network.

Qualified Dependents

Qualified dependents include a spouse or partner and unmarried minor children currently living with you at the time of the relocation, as determined by local laws.

Qualified dependents DO NOT include parents, extended family, adult children (except for those with intellectual or physical disabilities), married children, childcare provider, domestic help, and family pets/animals. Note that this is not an all-inclusive list.

Exception Approval

The Thermo Fisher Global Domestic Relocation Policy has been designed to provide an equitable and competitive relocation package. When a request is made for support that is outside of the scope of the policy, a written exception request must be made in advance and submitted to Global Mobility. Any deviation from standard policy benefits must be reviewed by Global Mobility and exceptions will require additional approval per the internal approval process. Global Mobility has the authority to deny any exception request.

Termination of Employment

If you voluntarily terminate your employment from Thermo Fisher, or if you are involuntarily terminated for cause, within two (2) years of the start date in the new location, Thermo Fisher reserves the right to be reimbursed for part, or all, of the relocation expenses. The Repayment Agreement must be signed by you before the commencement of the relocation and before any services can be authorized and initiated. Thermo Fisher is not obligated to pay any relocation costs associated with a move to another location after termination.

Any in-process or unused benefits will cease upon the last date of your employment.

Conflict of Interest

Thermo Fisher considers it a conflict of interest for relocating employees to employ the services of friends or relatives for the purposes stated in this policy.

Canada Domestic Relocation Policy Summary – Tier 3

BENEFIT DESCRIPTION

Miscellaneous Relocation Allowance

• One-time payment of CAD 15,000 net of taxes

• Additional allowance based on meeting eligibility criteria

Home Sale Assistance

• Marketing Assistance through our relocation partner

• Direct Reimbursement

Tax Gross-Up

• Gross-up of most taxable relocation expenses

Miscellaneous Relocation Allowance

The Miscellaneous Relocation Allowance is intended to offset the cost for various individual relocation expenses. You will receive a one-time payment equal to CAD 15,000, net of taxes. If you meet the eligibility criteria in the table below, additional funds will be provided as part of the one-time payment.

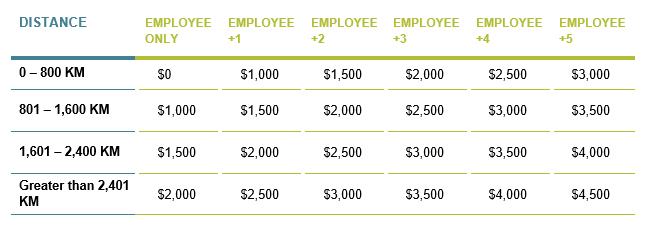

Additional Amount (in CAD) Based on Family Size and Distance to New Location:

The one-time payment, net of taxes, will be paid to you as follows:

• If you are an existing employee: no sooner than thirty (30) days prior to your agreed start date in the destination

• If you are a newly hired employee: upon your start/hire date in the destination location

Examples of the types of expenses this allowance can be utilized for:

• Home finding in the new location

• Shipment and storage of household goods

• Temporary housing

• Temporary transportation, such as rental car

• Flight and travel expenses

• Costs related to the relocation of family pets/animals (i.e., transportation, shipment, boarding, shots, etc.)

• Automobile licensing and registration, and operator’s fees, including driver’s licenses

• Charges for installation, connection, or disconnection of utilities (i.e., cable or satellite TV, electricity, water, etc.)

• Cleaning services at both origin and destination residences

• Purchase of travel items

• Loss or replacement of carpet/flooring drapes; or cost of installing or altering them

• New and non-standard appliance hookups

• Forfeited dues or non-refundable portions of service contracts and memberships (club, school, gym, etc.)

• Gratuities to movers/packers or other service vendors

• Professional tax or additional legal services

• Childcare expenses

• Any additional tax liability incurred because of the move not covered by this policy

• Other expenses not specifically covered by this policy

Selling Your Home

Home Sale Assistance Eligibility

Home Sale Assistance is available for your primary residence at the time of transfer. Your name must be included in the title to the home. Assistance is limited to occupied single-family dwellings, condominiums, or townhouses in Canada. Thermo Fisher will make the final determination as to whether your property is eligible for Home Sale Assistance.

Home Sale Assistance is not available for certain types of dwelling or property that are deemed cost prohibitive. The list below are examples of those dwellings/properties not available for Home Sale Assistance. This is not a complete list.

• Cooperative apartments

• Condominiums having restrictive by-laws which prevent a sale to the Company

• Duplexes

• Historical property designated as a landmark by the Secretary of the Interiors

• Property sold under a land contract or other deferred passage of title arrangements

• Seasonal or second residences

• Farms

• Income producing or investment properties

• Home with excess acreage or additional lots

• Properties that are zoned for agriculture

• Any home in which a part is used or zoned for non-residential purposes

• Properties held in a trust in which the employee is not named on the title

• Homes where the employee is not in title, or the title is not clear

• Severe marketability problems

• Zoning or easement disputes

• Homes during legal proceedings including divorce, foreclosure, short sale, etc.

• Homes with hazardous substances or improperly installed materials such as but not limited to biohazardous materials, radon, asbestos, synthetic stucco, defective LP siding, aluminum wiring, artificial veneer siding, defective stone veneer siding, imported corrosive drywall, illegal substances including the by-products thereof, vermiculite insulation, underground fuel tanks, urea formaldehyde, etc.

• Homes with defective composite siding

• Homes that cannot be financed by a lending institution or are uninsurable

• Homes uninhabitable or unmarketable due to the physical condition and/or homes that are structurally unsound

• Homes that do not qualify for standard insurance rates

• Homes that do not comply with local building codes

• Homes that are partially completed or are under substantial renovation

• Homes in which any structural additions, changes, or repairs have been made without all necessary permits and government approvals being obtained

• Homes with subrogated mineral rights

• Homes with Private Transfer Fee covenants (PTF)

• Houseboats, mobile or “tiny” homes

• Vacant lots or vacant land

• Homes with leased solar panels

• Homes which could be rendered unmarketable because of the employee misrepresenting information about defects

Inspections and Repairs

Inspections may be required and, if so, will be arranged by our relocation partner. If your home has a well or a septic system, inspections of those systems may be required as well. Additionally, any other inspections required due to recommendations presented or disclosed by the real estate agent, the appraisers, inspectors, or others, and in accordance with local customary process, will be arranged by our relocation partner. Thermo Fisher reserves the right to order inspections as deemed necessary.

If any inspection uncovers a deficiency, you will be responsible for remedying the problem. This can be done by arranging for a licensed contractor to complete the work required and submitting a paid invoice as documentation that repairs were completed. All repairs must be done by companies that will guarantee their work in writing, in the event additional problems occur. For certain repairs, a licensed and insured professional may be required. If you choose a company that does not guarantee its work, you will continue to be responsible for the cost of additional repair work.

Please be aware that all inspections ordered and obtained will be disclosed to any future purchaser as part of standard disclosure requirements. Typically, an outside buyer will order their own inspections on the property as well, and this may identify additional deficiencies in need of repair that a buyer may request. Please note it is your responsibility to negotiate any buyer repair requests and your relocation consultant will assist you in these negotiations.

Disclosure

It is the duty of the seller to make known to a buyer the condition of the property, particularly any defect that could affect its value, habitability, or desirability.

Real Estate Agent Selection

To remain eligible for all the benefits of the relocation program, you must work with our relocation partner’s preferred service partners, including real estate agents and inspectors. Do not sign a listing agreement until you have spoken with our relocation consultant.

The selection of a knowledgeable real estate agent is very important. You will be provided access to an approved Broker Network of the most qualified real estate agents available in your community, who specialize in assisting relocating employees. The agents in the Broker Network have been specifically trained to effectively market your home and address the needs that are unique to relocation. The use of the services of a friend, relative, or acquaintance in the real estate field is prohibited, even if in the Broker Network, and is seen as a conflict of interest.

It is recommended that you interview several real estate agents from the Broker Network list to assess their ability to effectively market your home. Please advise them that you are considering using their services and have been referred by our relocation partner.

Here are some of the questions you might ask them to help you in your selection process:

• In which locations and price ranges are you most active?

• How many homes similar to mine have you sold in the last ninety (90) days?

• How do you intend to market my home (number of open houses, how often and where will my home be advertised)?

• What are the comparable home listings and sales you will or have used to arrive at your recommended list price?

Your listing agreement must include the Broker Exclusion Clause. This clause protects you from having to pay an agent’s commission. If your listing agent has any questions regarding the Exclusion Clause, please contact our relocation consultant before signing the listing agreement.

Marketing Assistance Program

The relocation company will work closely with the employee, and the selected listing agent to develop a home marketing strategy. The relocation company will monitor the entire listing effort, including proactive marketing-strategy calls and follow-up on buyer and realtor feedback. During the offer review process, the relocation company will indicate any items the employee is considering contracting with an outside buyer for and will counsel on anything which may not be in their best interest or may not be reimbursable under the relocation program.

The relocation company’s Home Marketing Assistance helps relocating employees prepare their home for sale to attract the highest and best offer possible within a reasonable time frame. As part of this service, the relocation counsellor will:

• Provide recommendation and help select quality real estate agents from our relocation partner’s realtor network

• Schedule home valuation appointments (Broker Market Analyses)

• Review and analyze the Broker Market Analyses

• Review agents’ Marketing Strategy

• Monitor the agent throughout the process and review regular Market Activity Reports

• Ensure maximum market exposure for the property

• Assign a network closing attorney/notary

• Assist with the negotiating of offers.

Eligible home sale costs will be covered, provided these costs are reasonable and customary for the area, and may include:

• Real Estate Commissions

• Mortgage Prepayment / Discharge Penalties

• Legal/Notary fees, plus disbursements

You are financially responsible for your home until your home closes with an outside buyer. Once you receive a qualified offer from an outside buyer that is acceptable to you, the relocation company acts in conjunction with you and the realtor to coordinate the closing of the sale. As authorized by the company, the relocation company can either:

• Directly pay the commission and allowable closing costs directly to the assigned legal closing attorney on behalf of employee

Reimburse the employee eligible Closing Costs (if they are not utilizing a cooperating realtor and legal network partner)

Important: You must participate in the Marketing Assistance Program to receive Home Sale Assistance benefits under this policy.

Direct Reimbursement of Closing Costs

To receive direct reimbursement with tax assistance when you secure a buyer for your home, you will be reimbursed for the real estate agent’s sales commission and other typical and customary seller’s closing costs.

Examples of reimbursable costs include:

• Real estate commission (prevailing rate for the area, not to exceed 6%)

• Abstract of title/lenders’ title insurance

• Required legal fees

• Documentary tax/excise stamps, tax certificates

• State/provincial and local transfer taxes

• Survey expense

• Inspection fees as required by lender (termite, radon, etc.)

• Escrow/conveyance fee

• Local statutory costs

• Notary fees

• Mortgage recording or discharge fees

The following costs are examples of items that will not be reimbursed:

• Homeowner warranties

• Buyer closing costs

• Origination fees

• Allowances to the buyer (examples include repair or decorating allowances, homeowner’s association fees, or property tax credits)

• Buyer broker fees

• Contract review fees

These lists are not all inclusive. Questionable items should be addressed with our relocation partner before the scheduled closing.

Reimbursement will be coordinated by our relocation partner upon receipt of documented selling expenses (Closing Statement) via the expense reporting process. Keep in mind that by receiving reimbursement of your home selling costs, you will be required to attend the closing with the buyer.

Expense Management

Our relocation partner will audit and process your relocation expense reports. You must use our relocation partner’s online expense reporting tool to submit for reimbursement. Relocation expenses must be separate and distinct from business travel expenses and must not be submitted through the company’s travel and expense system. Expenses must be submitted within thirty (30) days of occurrence to be reimbursed.

Please note:

• Receipts must be submitted for all expenses (photos or scans). Please be sure to keep a copy of your receipts for your records

• Only expenses specifically outlined in the policy will be reimbursed. All reimbursable expenses must be reasonable and appropriate for the new work location

Upon approval of authorized expenses, you will be reimbursed through the relocation partner.

Tax Considerations

Please be advised that nothing in this program is intended to constitute tax or legal advice. Although the information contained herein is believed to be accurate, any statements or opinions in this program, including what is or is not taxable income, are provided for informational purposes only. You are encouraged to and should seek professional tax advice as to your particular circumstances and tax liabilities from competent tax and/or legal counsel. This program is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code or applicable provincial and local authorities.

Gross-Up Policy

Certain payments or reimbursements made by Thermo Fisher because of your relocation may be considered taxable income. Thermo Fisher will pay the estimated federal, state, social, and local taxes on your behalf to alleviate the additional tax burden created by such expenses, referred to as a gross-up. Gross-up payments are made directly to the applicable taxing authorities on your behalf and will be reflected on your end of year wage statement.

The gross-up will only consider your Thermo Fisher earned income.

Year-End Information

At year-end, you will be furnished with a copy of a Relocation Tax Report from our relocation partner. This will provide an itemized list of all reimbursements, payments, and allowances paid to you, or on your behalf for expenses incurred in connection with your move. You are responsible for reporting taxable moving expense reimbursements on your tax return.

Relocation Expense Repayment Agreement and Policy Acknowledgement

As of the effective date of this Relocation Expense Repayment Agreement (this “Agreement”) and Policy Acknowledgement (this “Acknowledgement”), Thermo Fisher Scientific (“Thermo Fisher”) has agreed to incur expenses or reimburse the undersigned employee (the “Employee”) for certain expenses for the purpose of relocating Employee and Employee’s qualified dependents to a new work location. The relocation benefits being offered are described in Thermo Fisher’s Canada Domestic Relocation Policy – Tier 3 (“Policy”).

Employee confirms that neither he/she nor any other qualified dependent is receiving relocation benefits from any other company or source. Employee acknowledges that relocation benefits paid by Thermo Fisher are subject to reduction in an amount equal to any relocation benefits paid by another source.

If, within twenty-four (24) months after the Employee’s start date in the new work location, (a) Employee voluntarily terminates employment with Thermo Fisher for any reason or requests a transfer out of the new work location, or (b) Thermo Fisher terminates Employee’s employment for cause, or (c) Employee does not relocate to the new work location, Employee agrees to repay Thermo Fisher, within thirty (30) days of terminating employment, any and all relocation expenses (including, but not limited to, expenses related to temporary housing, household goods move, home sale assistance, home purchase assistance, relocation allowances, home finding assistance, gross up taxes, service provider fees, immigration costs, etc.) or payments made in lieu of relocation benefits incurred by Thermo Fisher, in accordance with the timeline set forth below:

AMOUNT OF REIMBURSEMENT BASED ON CALENDAR TIME ELAPSED FROM START DATE IN NEW WORK LOCATION THROUGH TERMINATION DATE

0 months – 12 months 100%

13 months – 24 months 50%

If termination occurs after more than twenty-four (24) months, the Employee will not be required to repay relocation expenses.

Any repayment required under this Agreement will be due and payable to Thermo Fisher within thirty (30) days of terminating employment. Subject to compliance with local laws, Thermo Fisher reserves the right to deduct any sums due and owing to Thermo Fisher from Employee’s final paycheck(s), including, without limitation, salary, commissions, bonuses, vacation or other paid leave, severance or separation pay, and expense reimbursements, up to the full amount of the expense owed to Thermo Fisher.

If such deduction does not fully satisfy the amount of reimbursement due, Employee agrees to immediately repay the remaining unpaid balance to Thermo Fisher.

This Agreement also serves as an Acknowledgement that the Employee has been provided with a copy of the Policy. By signing this document, the Employee agrees to have read and understood the Policy which sets forth the relocation-related benefits offered by Thermo Fisher and accepts the terms and conditions.

I hereby understand that neither the Policy or this Agreement and Acknowledgement is a guarantee of employment. Furthermore, I understand that Thermo Fisher retains the discretion to amend, modify, suspend, terminate, or interpret the Policy at any time.

Relocation assistance will not begin until a signed Relocation Repayment Agreement and Policy Acknowledgement has been returned to Thermo Fisher.